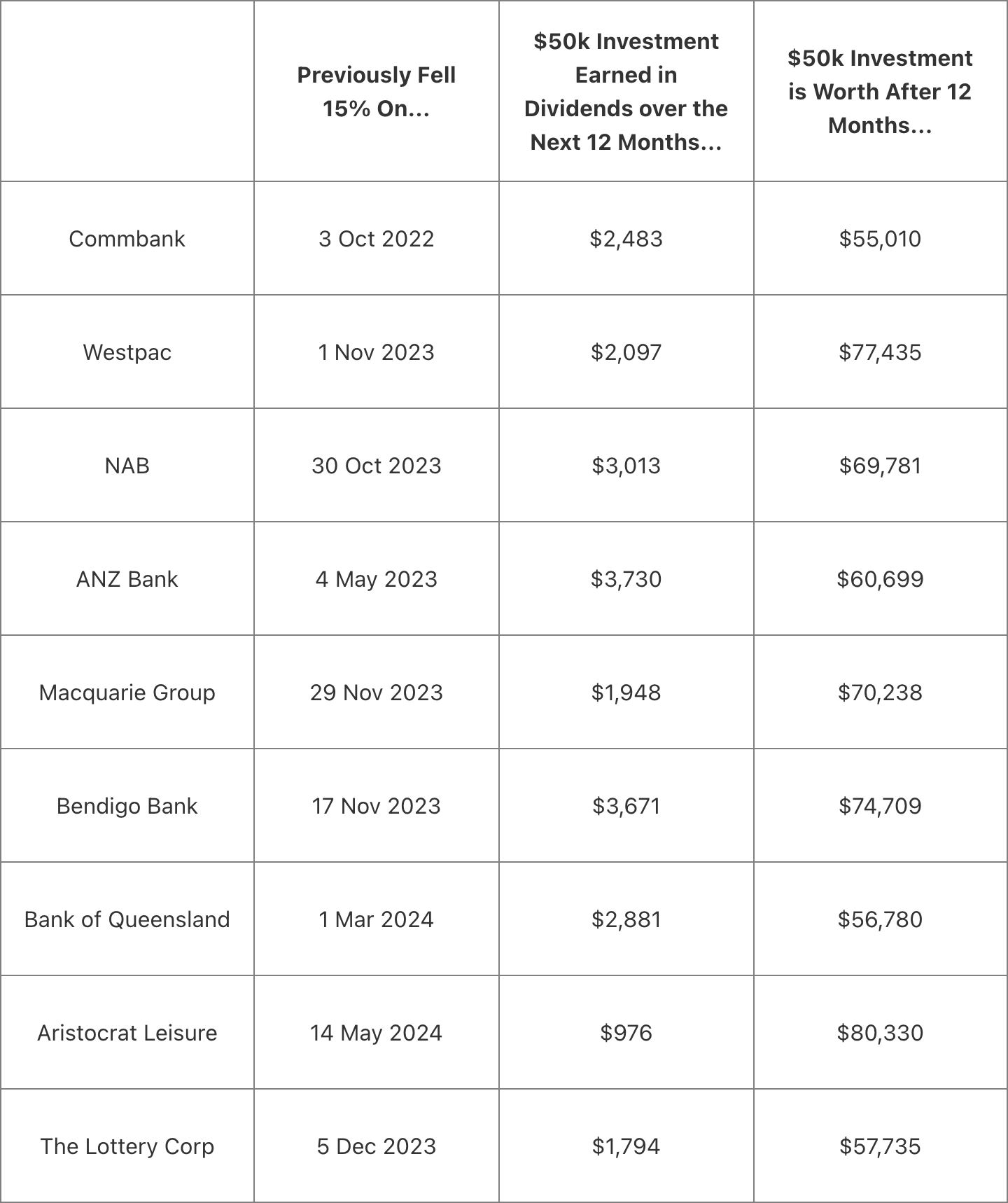

Stocks that Fell 15% Recently

Not a Recommendation to buy or sell. Educational purposes only.

I’ve selected a number of ASX-listed Financial and Gaming equities to look at what occurred last time these stocks fell 15%. All values are in AUD.

List of Stocks that Fell 15% Recently

This analysis examines only the most recent occurrence where each stock fell at least 15%. Income/return examples assume a $50k investment in the given stock on the given date.

Source: Market Data, ASX, S&P, VanEck.

In the above example, $50K is invested on the given date and the data shows an increase in value of that investment after 12 months. The displayed data also reflects dividend payments occurring within 12 months after each selected 15% decline. These specific outcomes may not recur. Investments can lose value, and dividends may be reduced or suspended.

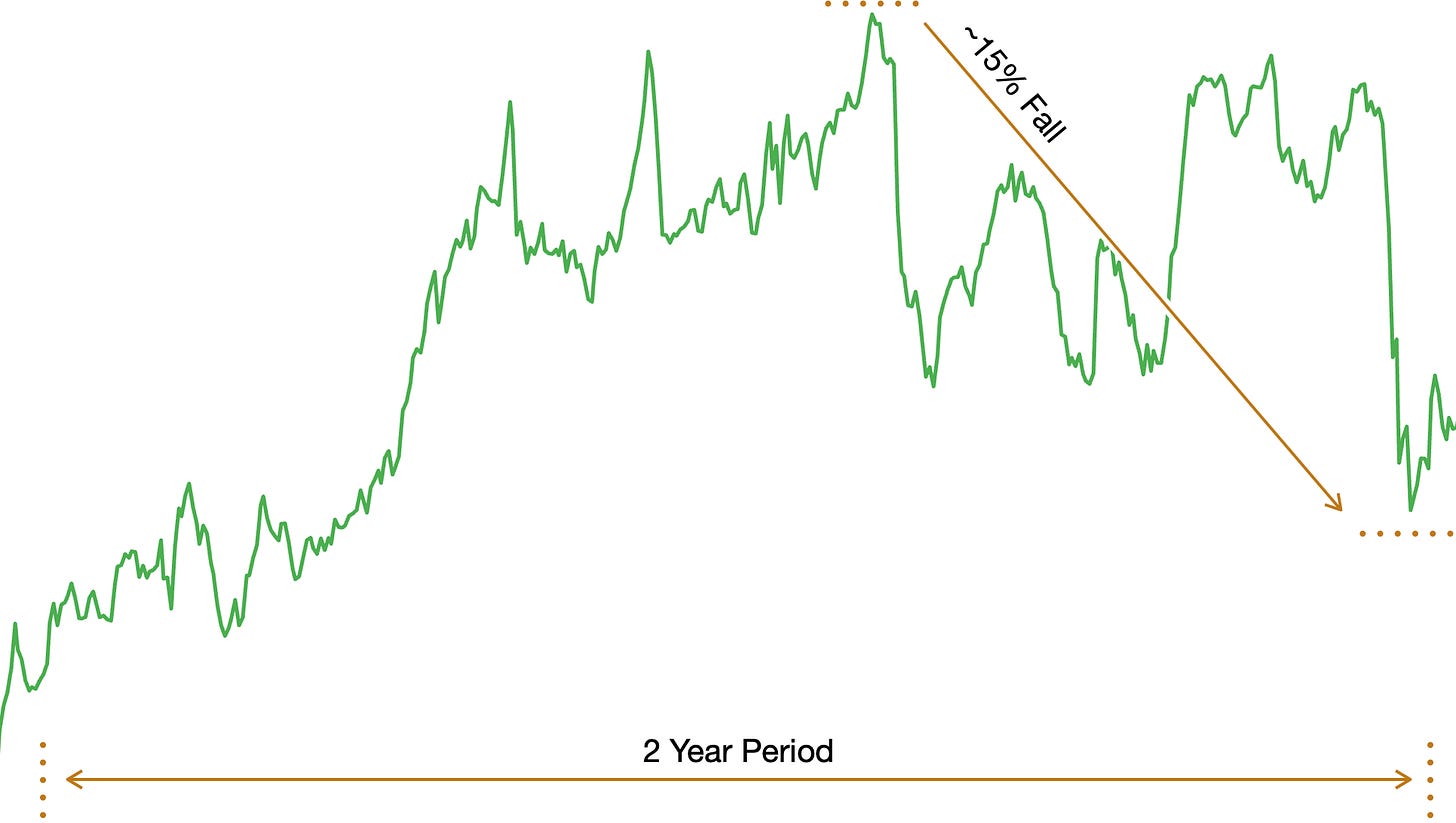

What Does a 15% (Or Any Percent) Decline Mean?

A percentage decline, such as 15% used in these examples, means that a stock fell from a high price to a low price of at least that percentage. The examples only look for price declines that occur within any contiguous 24 month period. 24 months is selected as an arbitrary value.

Why does a stock fall 15%? The prices of stocks can fall for many reasons and it is not possible to have an exhaustive list. Potential factors may include macroeconomic conditions - such as interest rates and currency fluctuations - and company-specific reasons.

Source: ASX:CBA, Market Data.

Will Prices Rise After a 15% Decline? Past performance is not a reliable indicator of future performance.

What can I earn in dividends? There is no guarantee that a stock will continue to pay dividends in future. However, that's why you have an investment manager, to help you make informed decisions and sleep well at night.